Mobile Payments

The Future of Payment Solutions: Mobile Payments

In today's fast-paced world, convenience and efficiency are key when it comes to payment solutions. With the rise of smartphones and mobile technology, mobile payments have become increasingly popular, offering users a seamless way to make transactions on the go.

What are Mobile Payments?

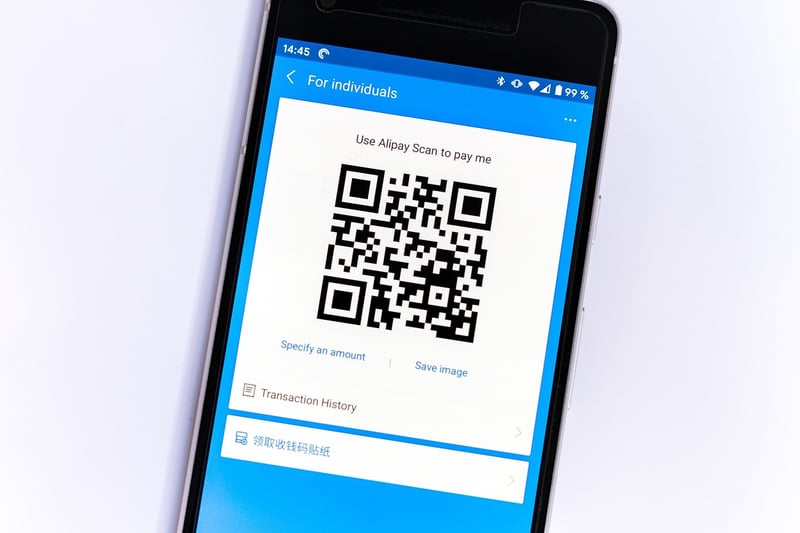

Mobile payments, also known as m-payments, are transactions made using a mobile device such as a smartphone or tablet. This method allows users to pay for goods or services digitally, eliminating the need for physical cash or cards.

The Benefits of Mobile Payments

- Convenience: With mobile payments, users can make transactions anytime, anywhere, without the need to carry cash or cards.

- Security: Mobile payment platforms use encryption and tokenization to protect user data, making transactions more secure than traditional methods.

- Speed: Mobile payments are quick and efficient, reducing the time spent at checkout lines.

- Rewards and Loyalty Programs: Many mobile payment apps offer rewards and loyalty programs to incentivize users to make purchases.

Popular Mobile Payment Platforms

Mobile Payments in Retail

Many retailers now accept mobile payments, allowing customers to pay for purchases using their smartphones. This trend is expected to continue growing as more businesses adopt mobile payment technology.

The Future of Payments

As technology continues to evolve, mobile payments are likely to become even more prevalent in the future. With the convenience, security, and speed they offer, mobile payments are poised to revolutionize the way we make transactions.

Embrace the future of payment solutions with mobile payments and experience a more efficient way to pay for goods and services.